Trading in financial markets, particularly in short-term strategies like day trading, can seem daunting. The idea of turning a modest investment like $75 into $1,000 in just 10 days sounds ambitious, but with the right knowledge, disciplined approach, and execution, it’s an achievable goal. The power of 5-minute candlestick patterns can unlock tremendous potential for traders willing to put in the time and effort.

In this guide, we’ll take you step-by-step through the fundamentals of candlestick patterns, how to identify key market opportunities, and how to manage risk to protect your capital while maximizing profits. Whether you’re a seasoned trader or a complete beginner, mastering these techniques will help you unlock the potential to make smart, profitable trades on platforms like Binance.

—

1. Master the Basics of Candlestick Patterns

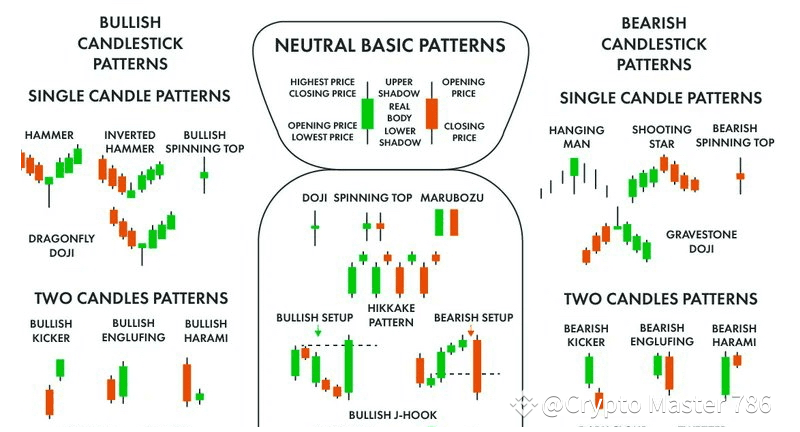

Candlestick patterns are the building blocks of technical analysis and represent a visual summary of market price movements. Each candlestick tells a story—offering insights into market sentiment and price action.

Understanding Candlestick Structure

The Body: Represents the opening and closing prices of the asset. A long body indicates strong momentum, while a short body suggests indecision in the market.

The Wick (Shadow): The lines above and below the body represent the highest and lowest prices reached during the timeframe. Long wicks indicate rejection of certain price levels.

5-Minute Charts: Your Best Friend in Day Trading

The 5-minute chart is perfect for those who want to capture quick, sharp movements in price. Every 5 minutes, a new candlestick forms, which is ideal for traders looking to enter and exit positions rapidly.

Why Master Candlestick Patterns?

Candlestick patterns show the battle between buyers and sellers, and with the right analysis, you can predict when a trend may change direction or when momentum will continue. Key patterns like hammers, doji, and engulfing candles give crucial signals to help identify reversals or continuation of trends.

Pro Tip: Study and familiarize yourself with common candlestick patterns such as bullish engulfing, bearish engulfing, morning stars, and shooting stars. Understanding these will be key to spotting profitable setups in real-time.

—

2. Identifying Reversal Patterns to Capture Market Turning Points

Reversal patterns provide valuable clues about potential price turning points. Recognizing these early on can help you enter or exit trades at the most opportune times.

Essential Reversal Patterns:

Bullish Engulfing: A large green candle that completely engulfs the previous red candle, signaling a potential upward shift in price.

Bearish Engulfing: A strong red candle overtaking the preceding green candle, indicating a potential downtrend.

Hammer: A small body with a long lower wick, suggesting strong buying pressure after a rejection of lower prices.

Shooting Star: A candle with a small body and a long upper wick, signaling the rejection of higher prices, often marking the start of a bearish trend.

Morning Star/Evening Star: These three-candle patterns often signal a reversal—either bullish or bearish—after a downtrend or uptrend.

Pro Tip: Never trade a reversal pattern alone. Always wait for confirmation before entering a trade. Look for a follow-up candle that moves in the direction you anticipate to increase the reliability of your trade setup.

—

3. Capitalizing on Continuation Patterns to Ride the Trend

When a trend is in full motion, continuation patterns are your tool to stay with the market momentum. These patterns suggest that the prevailing trend will continue after a brief pause or consolidation.

Key Continuation Patterns:

Bullish/Bearish Tweezers: A series of candles that show matching highs or lows, signaling that the trend is likely to continue.

Spinning Tops: Small-bodied candles with long wicks on both sides, indicating indecision, but often followed by a resumption of the trend.

Pro Tip: Combine continuation patterns with technical indicators such as moving averages or the RSI (Relative Strength Index) to confirm the trend’s strength. The stronger the trend, the more confidence you can have in your trade.

—

4. Gauging Trend Strength for Maximum Profit Potential

Recognizing the strength of a trend is crucial for optimizing your trades. A strong trend can give you the confidence to hold your position longer, while a weak trend may require quick exits.

Patterns That Signal Strong Trends:

Three White Soldiers: Three consecutive green candles closing progressively higher, indicating strong bullish momentum.

Three Black Crows: Three consecutive red candles closing lower, indicating heavy selling pressure and a strong downtrend.

Pro Tip: Volume is your friend. Trends accompanied by high volume are often more reliable. Use volume analysis to confirm the validity of the trend you’re seeing on the chart.

—

5. Utilizing Multi-Candle Patterns for Increased Reliability

Single-candle patterns are helpful, but multi-candle patterns often provide more reliable signals, as they show more complex market behavior. These patterns tend to offer stronger indications of future price movements.

Key Multi-Candle Patterns:

Three Inside Up: A bullish reversal pattern where the second candle is contained within the first, followed by a third candle that closes higher.

Three Inside Down: The bearish counterpart, signaling a reversal from an uptrend to a downtrend.

Pro Tip: Combine multi-candle patterns with support and resistance levels for greater precision. These levels serve as price barriers, and when broken, they often confirm the validity of the pattern.

—

6. Crafting a Risk Management Plan for Consistent Growth

Effective risk management is the cornerstone of long-term success in trading. Without it, even the best traders can lose everything in a single poorly managed trade.

Essential Risk Management Strategies:

Stop-Loss Orders: Always set stop-loss orders to limit potential losses. Place them just below (for long trades) or above (for short trades) significant support or resistance levels.

Risk 1-2% Per Trade: Limit your risk to just 1-2% of your capital on each trade. This way, even a series of small losses won’t put a serious dent in your overall portfolio.

Avoid Overtrading: Resist the urge to trade impulsively. Stick to setups that meet your criteria and avoid the temptation to jump into every opportunity.

Pro Tip: Keep a trading journal to track your progress. This will allow you to review your trades and improve your strategy over time.

—

7. A Step-by-Step Blueprint for Growing Your $75 into $1,000

Transforming $75 into $1,000 in 10 days requires strategy, patience, and discipline. Here’s a practical blueprint to help you achieve this goal:

1. Spot Trends: Look for powerful trends using patterns like Three White Soldiers or Three Black Crows.

2. Identify Reversals: Use Hammer or Morning Star patterns to enter trades at key turning points.

3. Set Stop-Loss Orders: Protect your trades with stop-loss orders to minimize downside risk.

4. Take Profits Smartly: Set clear profit targets and avoid being greedy. Stick to your plan.

5. Reinvest Profits: Gradually scale up your position sizes as you make profits, while reserving a portion of your gains to safeguard against potential losses.

—

8. The Keys to Consistency: Patience, Discipline, and Continuous Learning

Success in trading isn’t about luck—it’s about maintaining consistency, discipline, and a willingness to learn. The market is dynamic, and your trading plan must evolve with it.

Long-Term Success Strategies:

Practice on a Demo Account: Hone your skills without risking real capital. Platforms like Binance offer demo accounts that replicate real market conditions.

Focus on Real-Time Patterns: Build your confidence by analyzing live patterns as they unfold in the market.

Review and Adapt: Regularly assess your trading performance to identify what works and what doesn’t. Continuous learning and adaptation are key.

Pro Tip: Stay informed about global market-moving news and economic events. Understanding how external factors can affect market sentiment will help you make better decisions and anticipate price movements.

—

Conclusion: Your Journey to Trading Success on Binance

With the power of 5-minute candlestick patterns, combined with disciplined risk management and strategic decision-making, turning $75 into $1,000 is within your reach. Trading on Binance gives you access to a robust platform, offering the tools and features needed to execute fast, accurate trades.

By studying the fundamentals, practicing regularly, and staying patient, you can achieve financial growth—transforming small investments into significant profits over time. So, get started, stay focused, and let the market work for you. The rewards are there for those who put in the effort and stay disciplined.

Ready to take control of your trading destiny? Start small, trade strategically, and watch your investment grow. Your success story begins today!